When the General Assembly passed the South Carolina Business License Tax Standardization Act, or Act 176, in 2020, it put into motion an ongoing effort to standardize business licensing practices among municipalities and counties that levy a local business license tax. While the new law went into effect at the beginning of 2022, that did not mark the end of standardization work for cities and towns across the state — in fact, remaining compliant with the law means that municipalities will need to regularly update their business license ordinances and practices going forward.

Legislators intended for Act 176 to streamline the business licensing process, making it uniform and consistent for businesses operating in multiple jurisdictions across South Carolina. The requirements of the law therefore aim to ensure the licensing process will work the same for the business, no matter the jurisdiction involved.

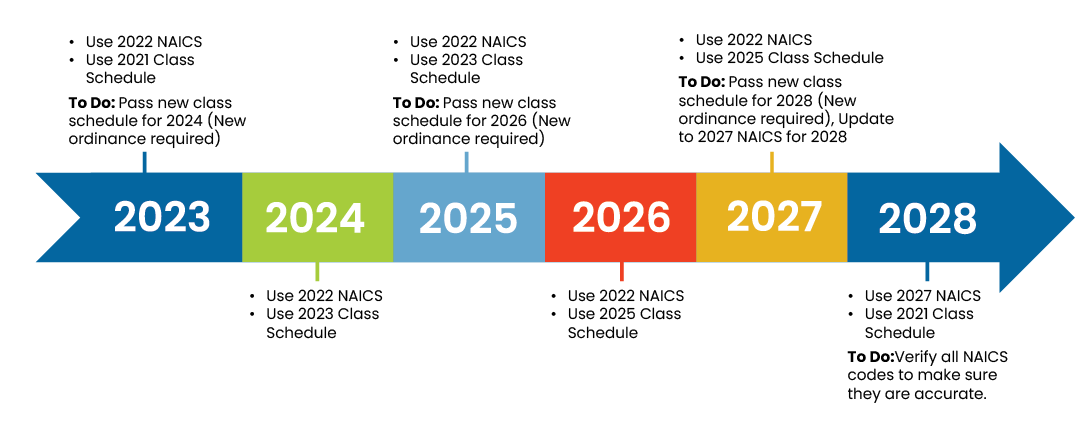

Two of those requirements are for cities to use the most current North American Industry Classification System codes, also known as NAICS codes, and for cities to update their class schedules every odd year to comply with the most recent statistical profitability data from the Internal Revenue Service.

This timeline illustrates the steps cities and towns will need to take each year through the next decade to stay compliant.

NAICS codes

The U.S. Office of Management and Budget updates NAICS codes every five years and released the most recent NAICS codes in 2022. Cities and towns need to ensure they assign the current NAICS codes to businesses beginning with the May 1, 2023 to April 30, 2024, business license year.

Updating the class schedule

Act 176 also requires jurisdictions with business licenses to use a standard class schedule for categorizing businesses accurately, which helps ensure that businesses are placed in the appropriate class. A standardized class schedule promotes clarity by providing businesses with an understanding of their licensing requirements based on their specific business activity. The standard schedule also ensures that licensing rates are equitable, regardless of the size or nature of the business.

To make updating the class schedule as simple a process as possible, the Municipal Association of SC developed a model business license ordinance that includes the updated standard class schedule. The Association distributed the 2023 class schedule in June.

Municipalities must adopt this class schedule by ordinance by December 31, 2023. This class schedule will be used for the business licensing year running from May 1, 2024 to April 30, 2025, as well as the license year running from May 1, 2025, to April 30, 2026. Once completed, cities and towns will not need to complete this process again until December 2025.

Keep Up With Business Licensing Issues

The  Municipal Association provides business licensing officials with several easy ways to stay up to date with business licensing practices. It offers “Business Licensing Essentials,” a virtual session for officials to learn about difficult licensing topics. Find future dates and topics on the Association’s Training Calendar. In 2024, these sessions will take place quarterly.

Municipal Association provides business licensing officials with several easy ways to stay up to date with business licensing practices. It offers “Business Licensing Essentials,” a virtual session for officials to learn about difficult licensing topics. Find future dates and topics on the Association’s Training Calendar. In 2024, these sessions will take place quarterly.

The Association also offers membership in the SC Business Licensing Officials Association, which promotes best practices for administering and enforcing local business license taxes to its members. BLOA membership includes an opportunity to achieve an Accreditation in Business Licensing and a Master in Business Licensing designation, and offers a listserve for business licensing officials around the state to ask questions and provide insight.