If you want to see a blank stare, just ask a taxpayer if he can explain what a mill represents on his tax bill. Admittedly understanding how millage is applied is a complex process.

A mill is the rate of tax used to calculate local property taxes. A tax bill includes a number of technical terms, including millage rate, assessment rate and assessed value.

Property tax terms

Appraised value - fair market value of property

Assessment ratio - percent of fair market value property upon which the tax rate will be applied

Assessed value - taxable value of property = appraised value x assessment ratio

Mill - one thousandth of one dollar (1/1,000 per $1)

Millage or tax rate - tax rate applied to assessed value

The South Carolina Constitution sets eight classifications of property, each with a different assessment rate. Legislators established the different rates so owners who earn an income from their property would pay a higher tax.

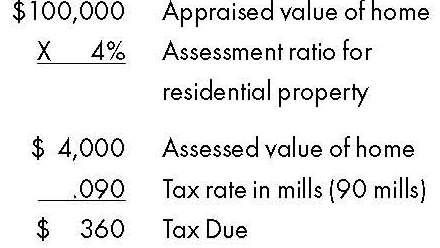

Therefore, manufacturing property has a 10.5 percent assessment rate and commercial property has a 6 percent rate, while owner-occupied residential property is assessed at 4 percent.

So exactly what is a mill? One mill is equal to one thousandth of a dollar per $1 of assessed property value.

If a city council approves a tax of 90 mills, then the taxpayer will pay $90 per $1,000 of assessed property value.

The value of a mill varies across the cities and towns in South Carolina. The cities with higher total assessed or taxable property values have the highest value per mill. Hilton Head Island's total assessed property value is $555 million; therefore, the tax value per mill is $910,000. This means the city will collect $910,000 in total property taxes for every mill the council sets as its tax rate.

However, cities with low total property values do not raise as much revenue per mill. For example, the Town of Lane has a total assessed value of $550,000. Lane will collect only $531 per mill.

On average, property tax revenue represents 26 percent of a city's total revenue. It is an important and stable source of revenue for cities to fund services such as police and fire protection, code enforcement and sanitation services. Councils must balance the needs for city services against the financial resources of their property owners when setting a city's millage rate.